How to Use a Forex Profit Calculator to Plan Your Trading Strategy

Forex trading is a complex and risky activity that requires careful planning and analysis. One of the most important aspects of forex trading is to know how much profit or loss you can expect from a trade before you enter it. This can help you to set realistic goals, manage your risk, and optimize your performance.

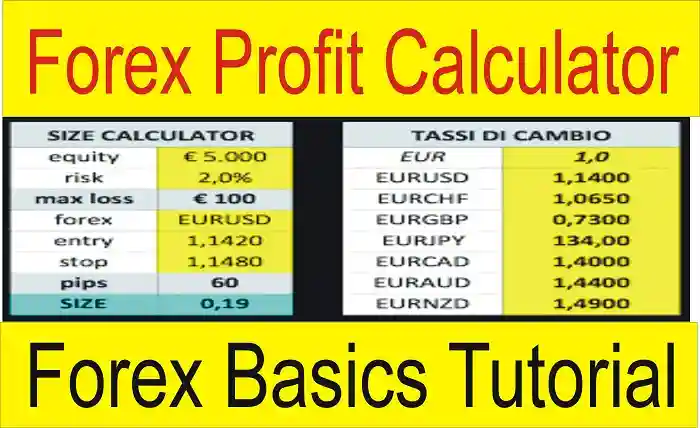

A forex profit calculator is a handy tool that can help you to calculate the potential profit or loss of a trade based on various factors, such as the currency pair, the trade size, the entry and exit prices, and the leverage. By using a forex profit calculator, you can easily compare different scenarios and choose the best option for your trading strategy.

What is a Forex Profit Calculator?

A forex profit calculator is an online tool that allows you to input the details of a trade and see the possible outcomes in terms of money and pips. A pip is the smallest unit of price movement in the forex market, usually equal to 0.0001 for most currency pairs. For example, if the EUR/USD exchange rate changes from 1.2000 to 1.2001, it means that it moved by one pip.

A forex profit calculator can show you how much money you can make or lose from a trade based on the following factors:

- Currency pair: The two currencies that you are trading, such as EUR/USD, GBP/JPY, or AUD/NZD.

- Trade size: The amount of units or lots that you are trading. A lot is a standard unit of measurement in the forex market, usually equal to 100,000 units of the base currency. For example, one lot of EUR/USD is equal to 100,000 euros. Some brokers also offer mini lots (10,000 units), micro lots (1,000 units), or nano lots (100 units) for smaller traders.

- Entry price: The price at which you open the trade, either by buying or selling the currency pair.

- Exit price: The price at which you close the trade, either by buying or selling the currency pair.

- Direction: The direction of your trade, either long or short. A long trade means that you buy the base currency and sell the quote currency, expecting the base currency to appreciate in value. A short trade means that you sell the base currency and buy the quote currency, expecting the base currency to depreciate in value.

- Leverage: The ratio of borrowed funds to your own funds that you use to increase your trading exposure. For example, if you have $1,000 in your account and use a leverage of 100:1, you can control a position worth $100,000. Leverage can magnify your profits or losses depending on the market movements.

How to Use a Forex Profit Calculator?

Using a forex profit calculator is simple and straightforward. You just need to follow these steps:

- Choose a reliable and reputable forex profit calculator from one of the many available online sources.

- Select the currency pair that you want to trade from the drop-down menu or type it manually.

- Enter the trade size in units or lots according to your preference and account type.

- Enter the entry price and exit price of your trade based on your analysis or trading signals.

- Select the direction of your trade, either buy or sell.

- Enter the leverage that you are using or plan to use for your trade.

- Click on the calculate button to see the results.

The results will show you:

- The profit or loss in money (converted in your account base currency) and also the profit or loss in pips.

- The margin required for your trade based on your leverage and account type.

- The swap or rollover fee that you may incur if you hold your position overnight.

- The spread or commission that you may pay to your broker for executing your trade.

You can also adjust any of the input parameters and see how they affect the results. For example, you can change the exit price to see how much profit or loss you would make if you close your trade at a different level. You can also change the leverage to see how it affects your margin requirement and risk exposure.

Why is it Important to Use a Forex Profit Calculator?

Using a forex profit calculator can help you to plan your trading strategy and improve your performance in several ways:

- It can help you to set realistic and achievable profit targets based on your analysis and expectations.

- It can help you to manage your risk and control your losses by setting appropriate stop-loss levels based on your risk tolerance and trading capital.

- It can help you to optimize your position size and leverage based on your risk-reward ratio and trading objectives.

- It can help you to compare different trading scenarios and options and choose the best one for your situation.

- It can help you to evaluate your trading results and performance and identify your strengths and weaknesses.

Conclusion

A forex profit calculator is a useful tool that can help you to calculate the potential profit or loss of a trade based on various factors, such as the currency pair, the trade size, the entry and exit prices, and the leverage. By using a forex profit calculator, you can easily compare different scenarios and choose the best option for your trading strategy. However, you should also remember that a forex profit calculator is not a substitute for your own analysis and judgment. You should always use multiple sources of information and tools to make your trading decisions.