Home Insurance vs. Home Warranty: Understanding the Differences and Making Informed Choices

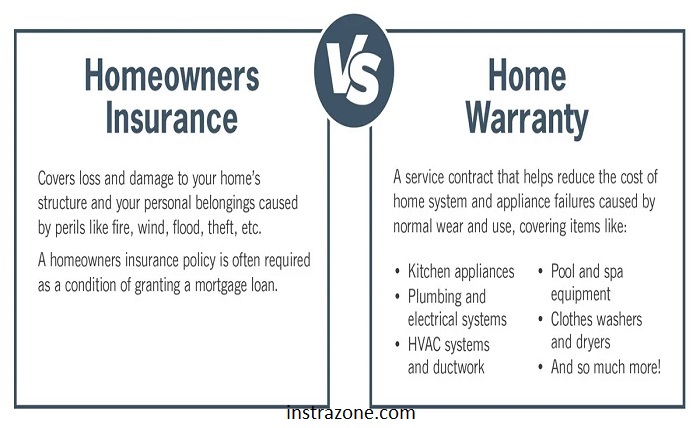

Homeownership is a significant milestone, and protecting your investment is crucial. Two common types of protection are home insurance and home warranties. However, they cover different aspects of your home, and understanding their disparities is essential for adequate protection.

Home Insurance:

Home insurance is a comprehensive policy designed to safeguard your home and its contents against various risks. These risks typically include damage caused by fire, theft, natural disasters, and liability coverage for injuries that may occur on your property.

Key Points:

Coverage: Home insurance provides financial protection for the structure of your home, personal belongings, and liability coverage.

Events Covered : It safeguards against a broad range of perils, such as fire, vandalism, theft, and natural disasters like earthquakes or floods (depending on the policy).

Mortgage Requirement : Most lenders require homeowners to have insurance to secure a mortgage.

Home Warranty:

A home warranty, on the other hand, is a service contract that covers the repair or replacement of major home systems and appliances. It is not a form of insurance but rather a protection plan for your home’s vital components.

Key Points:

Coverage : Home warranties typically cover systems like HVAC, plumbing, electrical, and major appliances such as refrigerators and ovens.

Events Covered : Unlike insurance, home warranties focus on normal wear and tear rather than unexpected events. They are especially useful for aging homes with older systems and appliances.

Optional Purchase : While insurance is often mandatory, home warranties are optional and can be purchased at any time.

Comparative Analysis:

1. Coverage Scope:

Home insurance offers broader coverage, protecting against a wide array of perils. It ensures financial support for rebuilding your home and replacing personal belongings. In contrast, home warranties are more specific, focusing on essential systems and appliances.

2. Event Coverage:

Home insurance is event-driven, responding to sudden and unexpected incidents like a fire or theft. Home warranties, however, cover wear and tear, addressing the gradual breakdown of systems and appliances over time.

3. Financial Protection:

Home insurance provides financial security for major catastrophic events, giving you peace of mind in the face of unexpected disasters. Home warranties offer financial relief for the ongoing maintenance and repair costs associated with regular wear and tear.

4. Mandatory vs. Optional:

Home insurance is typically mandatory, especially for homeowners with mortgages. Home warranties are optional, allowing homeowners to decide whether the additional protection is necessary for their specific needs.

Conclusion:

home insurance and home warranties serve distinct purposes in protecting your home investment. Home insurance is essential for safeguarding against unexpected events, providing broad coverage for various perils. On the other hand, home warranties are optional and focus on the maintenance and repair of critical systems and appliances affected by normal wear and tear. A comprehensive approach involves having both, ensuring that your home is shielded from a wide range of risks, both sudden and gradual.

FAQ:

Q1: Can I have both home insurance and a home warranty?

A1: Yes, having both provides comprehensive protection. Home insurance covers unexpected events, while a home warranty addresses the wear and tear of essential systems and appliances.

Q2: Are home warranties only for older homes?

A2: No, home warranties can benefit homes of any age. They are particularly useful for older homes with aging systems and appliances.

Q3: Is home insurance required for all homeowners?

A3: While home insurance is often mandatory, especially for those with mortgages, it is advisable for all homeowners to have it to ensure financial protection against unforeseen events.